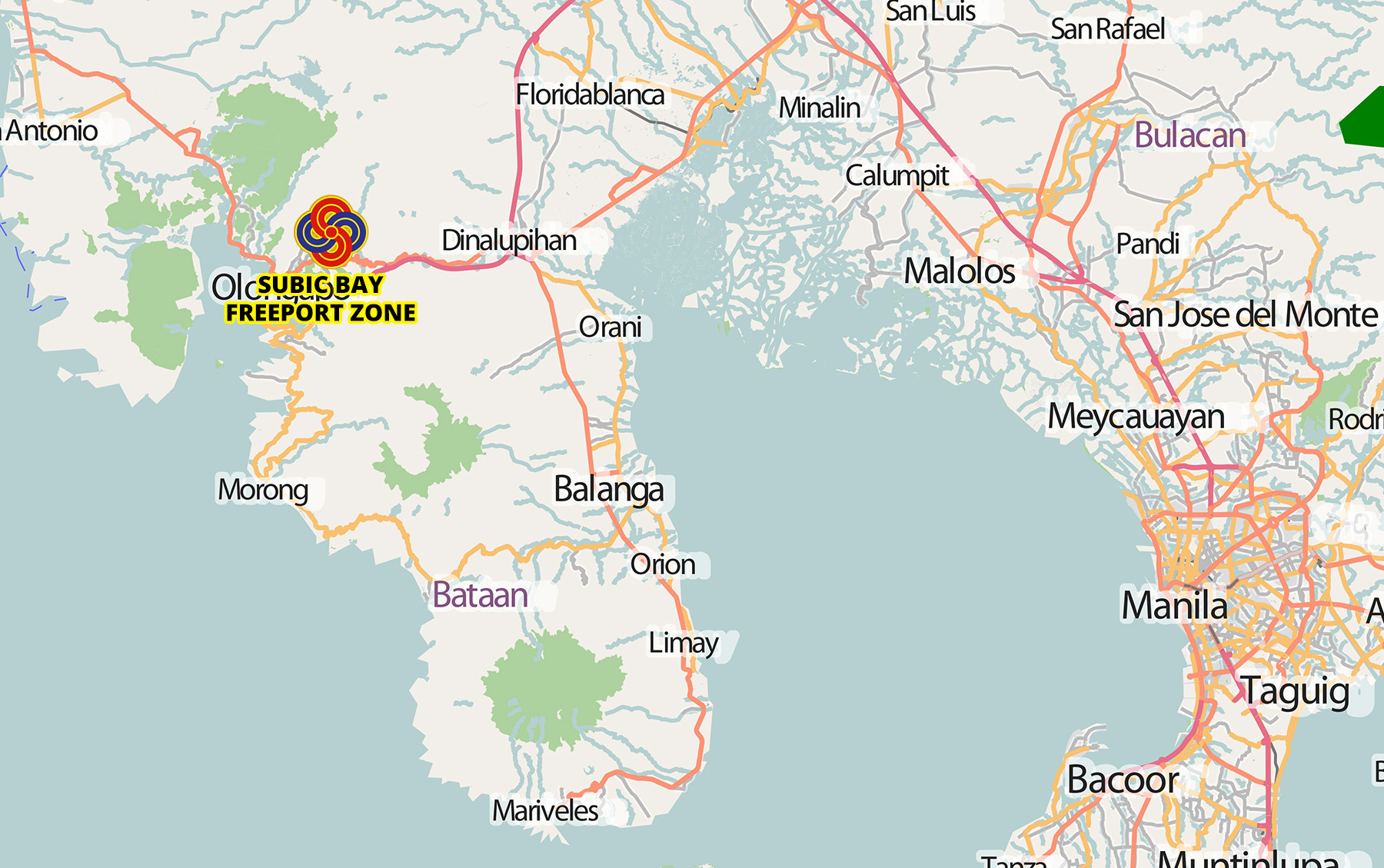

Subic Bay Freeport Zone

The Subic Bay Metropolitan Authority (SBMA) is the operating and implementing arm of the Government of the Philippines for the development of the 262 square mile (670 square kilometer) area of Subic Bay Freeport (SBF) into a self-sustaining tourism, industrial, commercial, financial, and investment center to generate employment opportunities. This area was the former US Naval facility in Subic Bay.

PORT LOGISTICS

- Industries engaged in port transshipment, freight forwarding, cargo handling, warehousing and storage

- Available spaces for storage and warehousing

- Cold storage facility operations for meat/ fish processing plants, meat importers, fruits/vegetables importers for local and exports, ice makers/manufacturers

- Port users in Metro Manila, and Central and Northern Luzon

- Ship layups

- Floating terminals

- Petroleum transshipment, storage, export and import

- International/regional/domestic passenger & cruise ship destination

GENERAL AVIATION

- Commercial or chartered aircraft operations

- Air cargo handling & warehousing

- Maintenance, repair & overhaul (MRO)

- Aircraft detailing

- Flight training

- Fixed based operation (FBO)

- Technical stop operation

- Available areas for development within airport premises

MARITIME

- Shipbuilding

- Ship Repair / Ship Conversion

- Super Yacht Marina Development

- Yacht Building

- Yacht Repair / Refurbishing

INFORMATION TECHNOLOGY COMMUNICATION

- Call Centers

- Business Process Outsourcing

- Software Design & Development

- Animation

- Telecommunications

- Other technology-based industries

TAX INCENTIVES

- Exemption from all local and national taxes with only a 5% final tax on gross income earned computed based on Gross Sales less the following “allowable deductions” depending on the activities such as manufacturing, infrastructure, development and service, in reference to Section – 57 of the Rules and Regulations implementing R.A. 7227, as amended by R.A. 9400.

- Raw Materials

- Intermediate goods & finished products

- Production/services supervision salaries

- Direct salaries, wages or labor expenses

- Financing charges associated with fixed assets

- Supplies and fuels used in the production/rendering services

- Rent and utility charges associated with buildings and equipment

- Depreciation, lease payments, or other expenditures on building and equipment

- SBF enterprises, depending on the specific type of enterprise, are likewise allowed to deduct some other expenses as specified under the law.

- Tax and Duty-free importations of raw materials, capital and equipment

- Up to 100% foreign ownership.

- No foreign exchange control; full repatriation of profit is allowed.

- Percentage of Income allowable from Sources Within the Customs Territory

SBF Enterprises may generate income from sources within the Customs Territory of up to thirty percent (30%) of its total income from all sources, provided, that should an SBF Enterprise’s income from sources within the Customs Territory exceed thirty percent (30%) of its total income from all sources, then it shall be subject to the income tax laws of the Customs Territory; provided, further, that in any case, customs duties and taxes must be paid with respect to income from sales and articles to the Customs Territory

OTHER INCENTIVES

- Visa-free entry for 14 days, renewable.

- Special Subic-Clark visas available to expatriates.

NEWS

[no_blog_list type=”image_in_box” order_by=”date” order=”DESC” number_of_posts=”10″ category=”SBMA” text_length=”200″]